According to Piseo CEO Joël Thomé, the UV lighting industry will see periods “before” and “after” the COVID-19 pandemic, and Piseo has combined its expertise with Yole to examine trends in the UV LED industry.

“The health crisis caused by the SARS-CoV-2 virus has created an unprecedented demand for the design and manufacture of disinfection systems using optical UV light. LED manufacturers have seized this opportunity and we are currently seeing an explosion of UV-C LED products growth," Thomé said.

Yole's report, The UV LEDs and UV Lamps - Market and Technology Trends 2021, is a survey of UV light sources and the overall UV LED industry. Meanwhile, the UV-C LEDs in the Time of COVID-19 - update November 2021 from Piseo discusses the latest developments in UV-C LEDs technology and the possibility to further develop performance and price. This technical analysis provides a comparative overview of the offerings of 27 leading UV-C LED manufacturers.

UV lamps are a long-established and mature technology in the UV lighting market. The pre-COVID-19 business was primarily driven by polymer curing using UVA wavelength light and water disinfection using UVC light. On the other hand, UV LED technology is still emerging. Until recently, the business was mainly driven by UVA LEDs. It was only a few years ago that UVC LEDs reached early adopter performance and cost specifications and started generating revenue.

Pierrick Boulay, senior technology and market analyst for solid-state lighting at Yole, said: “Both technologies will benefit, but at different times. In a very short time, UV lamps may dominate end systems because they are already established and easy to integrate. However, this The proliferation of such applications is a catalyst for the UV LED industry and will further drive the technology and its performance forward. In the medium to long term, some end systems may see further adoption of UV LED technology.”

Epidemic demand

Epidemic demand

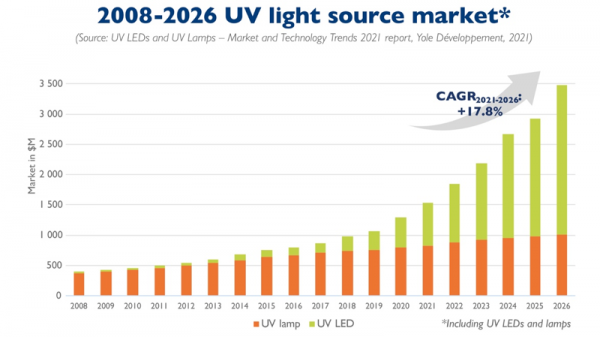

The overall value of the UV lighting market in 2008 was approximately $400 million. By 2015, UV LEDs alone will be worth $100 million. In 2019, the total market reached $1 billion as UV LEDs expanded into UV curing and disinfection. The COVID-19 pandemic then drove demand, increasing total revenue by 30% in just one year. Against this backdrop, analysts at Yole expect the UV lighting market to be worth $1.5 billion in 2021 and $3.5 billion in 2026, growing at a CAGR of 17.8% during the 2021-2026 period.

Many industries and players offer UV lamps and UV LEDs. Signify, Light Sources, Heraeus and Xylem/Wedeco are the top four manufacturers of UVC lamps, while Seoul Viosys and NKFG are currently leading the UVC LED industry. There is little overlap between the two industries. Analysts at Yole expect this to be the case even as some UVC lamp makers such as Stanley and Osram are diversifying their activities into UVC LEDs.

Overall, the UVC LED industry is likely to be the one most affected by recent trends. For this moment to come, the industry has been waiting for more than 10 years. Now all players are ready to take a piece of this booming market.

UV-C LED related patents

Piseo said the surge in patent filings related to UV-C light-emitting diodes over the past two years illustrates the dynamism of research in this area. In its latest UV-C LED report, Piseo focused specifically on key patents from four LED manufacturers. This choice highlights the main challenges of the technology rollout: intrinsic efficacy and cost. Yole also provides a complementary analysis of the patent area. The need for disinfection and the opportunity to use small light sources has made it possible to create increasingly compact systems. This evolution, including new form factors, has clearly piqued the interest of LED manufacturers.

Wavelength is also a key parameter for germicidal efficiency and optical risk assessment. In the "UV-C LEDs in the Age of COVID-19" analysis, Matthieu Verstraete, Innovation Leader and Electronics & Software Architect at Piseo, explained: "Although currently relatively scarce and expensive, some system manufacturers, such as Signify and Acuity Brands, since this optical radiation is not harmful to humans, there is a strong interest in light sources emitting at the 222 nm wavelength. Several products are already on the market, and many more will integrate excimer sources from Ushio.

The original text is reproduced in the public account [CSC Compound Semiconductor]

Post time: Jan-24-2022